When the time comes to move, some tenacious homeowners in North Carolina are eager to take over the reins of their home sale and figure out how to sell a house by owner.

With millions of homes sold each year, a modest portion of sellers — about 7% in 2021 and 10% in 2022 — choose to list “For Sale By Owner” (or FSBO — pronounced fizz-bow). Of those, 50% already knew the buyer of the home, according to data from the National Association of Realtors (NAR).

In this guide to selling FSBO in North Carolina, we’ll cover what can be the most difficult aspects of selling by owner in the Tar Heel State, including the steps that might be harder than you think. We’ll also provide a comprehensive overview of the full process to prep, market, and close on your home without the assistance of a real estate agent.

Note: Once you’ve seen what’s required, you can roll up your sleeves and get started with your FSBO sale. Or — in the event you’d prefer to work with a real estate agent — HomeLight would be happy to introduce you to highly-rated professionals in your North Carolina market who can help you command top dollar and provide a low-stress selling experience.

How does selling by owner (FSBO) work in North Carolina?

Disclaimer: This blog post is intended for educational purposes only. HomeLight recommends that you look into the real estate regulations for your area and consult a trusted advisor.

FSBO is a method of selling your home without the involvement of a listing agent. In a FSBO scenario, the seller assumes the responsibilities that would normally fall to their agent, such as pricing the home, marketing it to potential buyers, arranging showings, and negotiating the deal.

In an agent-assisted sale, the seller typically pays a commission amounting to around 6% of the sale price, which is then most often split 50/50 with the buyer’s agent. That 6% is deducted from the seller’s proceeds at closing. By selling FSBO, a seller can eliminate the cost of the listing agent’s commission (so around 3%), though they may still need to offer a buyer’s agent commission.

Buyers’ agents will expect compensation for the work they do to bring a buyer to a sale, such as arranging showings and helping to tee up and qualify the buyer. Plus, when a seller isn’t working with an agent, the buyer’s agent may end up carrying more of the weight to get the deal to the finish line.

Sellers should also consider things like whether or not their HOA will allow yard signs (many don’t!) or if they can put their house on the multiple listing service (MLS). While you don’t need a real estate agent to do this in North Carolina, you also can’t do it yourself — you would need to hire a flat-fee MLS listing service to do it for you, and you’d still have to provide your own listing information and photos.

Next: Consult our guide on who pays closing costs when selling a house by owner for more details.

Finally, a FSBO sale does not mean that a seller won’t need any professional assistance. In North Carolina, sellers are required to use a real estate attorney, and FSBO sales typically warrant legal and professional oversight of some kind to avoid an abundance of legal risk.

Most people who sell by owner will need to hire an attorney to review and prepare key documents and make sure paperwork is filled out properly, such as the seller’s disclosures.

We’ll address what disclosures are required when selling a house in North Carolina later in this post.

Why sell a house by owner in North Carolina?

The top three reasons people cite for selling FSBO include: “did not want to pay a commission or fee” (44%); sold to a relative, friend, or neighbor (29%); or that the buyers contacted the seller directly (16%), according to NAR data.

To get a firsthand perspective on selling homes in North Carolina, we spoke with experienced agents who specialize in the southern states, asking them to share their insight as to how the process works and some of the things FSBO home sellers should consider.

Top-selling agent Kevin Richter, based in nearby Charleston, South Carolina, is very familiar with the region’s housing market. He says that most of the FSBO sellers he encounters “believe that they can save money on commissions and make more money at the table.”

However, 2022 data from NAR shows that “FSBO homes sold at a median of $225,000, significantly lower than the median of agent-assisted homes at $345,000.” This NAR data contrasts the median prices among all FSBO homes (for which we have limited data) against all agent-assisted homes, regardless of distinctions like square footage. However, an independent study from 2016 to 2017 which does adjust for square footage, also shows a significant price difference: FSBO homes sold for an average of 5.5% less than agent-marketed sales.

Keri Shull, a top Virginia-based agent with 21 years of experience in several southern states, adds that sellers who choose FSBO often expect to save money, but don’t realize that they will still need to pay the buyer’s agent commission, and that the net proceeds when selling by owner can actually be much less.

“Their perception is they’re saving six percent,” she explains. “But really, what they’re talking about is the listing agent commission (around 3%). And often the amount they would make with a listing agent is dramatically more than what they save on that commission.”

As you can see, FSBO is a mixed bag. So, before we share our selling tips, let’s lay out some pros and cons to help you decide if this is the route for you.

Pros of selling a house by owner

- Ability to save on listing agent commission fees, usually around 3% of the sale price.

- You’re entirely in charge and can manage the sale as you please.

- No “go-between” in your communications with buyers.

Cons of selling a house by owner

- FSBO listings tend to sell for less, statistically speaking. Unless the seller already has a buyer lined up, FSBO listings can take longer to sell. For example, according to Richter, FSBO homes in his region can spend two extra weeks or more on the market.

- Managing all communications and negotiations yourself is time-consuming. Not having a communication buffer can be a downside if the buyer pushes back or says negative things about your property.

- You’ll be negotiating without help from an expert, which could mean leaving money on the table.

- Setting the listing price is challenging — you may be tempted to go too high. You could also risk under-selling with a low price.

- Marketing your home is time-consuming.

- You’ll still have selling costs, which may include transfer taxes and settlement fees. Not having agent representation could also lead to paying more in seller concessions.

- Without the help of an agent to guide you through the disclosure process, you may put yourself at legal risk to be held liable for potential future problems with your home.

In spite of the cons, we’ll help you navigate the challenges of FSBO if you’re committed to selling your North Carolina house without agent assistance. For some, selling a home FSBO is a challenge worth accepting, and success can be measured in more ways than one.

Steps to sell a house by owner

Next, let’s review the FSBO process step by step.

1. Prepare your house for sale

Whether you’re selling with an agent or FSBO, at a minimum, you’ll want to get your North Carolina home into respectable shape before any showings to increase your chances of receiving a fair price. Here are a few standard tasks to add to the list.

Indoors

These efforts will go a long way toward impressing buyers looking for a home in North Carolina:

- Declutter floors, shelves, and surfaces throughout the home.

- Make small fixes and repairs, like a leaky faucet or broken door handle.

- Lightly update with new light fixtures, faucets, or cabinet hardware.

- Refinish hardwood floors.

- Repaint bold walls (or those that look dingy) in a neutral color.

- Reduce furniture in crowded rooms — consider a temporary storage unit.

- Stage the home with final touches like fresh-cut flowers or a basket of fresh produce.

- Use rugs to define spaces and place them strategically.

- Deep clean until the house is sparkling.

- Open blinds or drapes to show off a great view and add natural lighting. Replace any dim, blown, or missing bulbs with bright bulbs.

- If your home is on or near the coast, address any wear and tear related to that refreshing, but sometimes damaging, ocean air.

Richter, who works with 74% more single-family homes than average agents in his market, stresses the importance of depersonalizing the home by removing personal photos and items that might detract from the home itself.

“Help people see themselves in your house as opposed to seeing you in their home,” he says, adding “I also recommend starting the great purge,” It’s unlikely that you’ll take all of your current possessions with you to your next house, so pack up what you no longer need and either donate, have a yard sale, or throw things away.

Outdoors

Data from HomeLight’s 2022 Top Agents Insight Report shows that, on average, “Buyers will pay 7% more for a house with great curb appeal versus a home with a neglected exterior.”

Some important curb appeal upgrades can include:

- Mow the lawn and pull weeds.

- Apply fresh mulch liberally.

- Upgrade your landscaping. Consider a new walkway, flowerbed, or shrubs.

- Add a fresh coat of exterior paint.

- Install a new garage door if yours is looking old or not working properly.

- If your backyard has red or white oak trees (common in North Carolina) you probably already know that they drop leaves in winter, so be sure to rake up any debris and trim any wayward branches.

Richter recommends “adding that little touch of character to sell the lifestyle more than just the home itself.” He suggests a hammock in the yard or brightly colored Adirondack chairs to create a relaxing atmosphere for potential buyers.

2. Do the homework necessary to set a competitive price

You’ve arrived at a critical moment in your FSBO process: setting a listing price. You don’t want to leave money on the table, yet you want to encourage activity on your listing.

Before listing a home, an agent usually conducts a comparative market analysis (CMA). This is a highly-detailed study of “comps” — similar homes nearby that have sold recently, are pending, on the market, or were previously listed but taken off the market. Some may have even been pulled off the market without a sale.

“Overpricing is a catastrophic mistake in today’s market because it’s your one chance to make a good first impression. If buyers see that a property has been reduced and reduced again, they think something’s wrong with it,” says Shull. “The seller may ultimately have to reduce to an even lower price. It’s best to price correctly the first time.”

Without an agent, you’ll miss out on the complexity of a full CMA and the know-how to interpret it.

However, with a little time and money, you can set a competitive price yourself.

Conduct your own “CMA Lite”

It’s time to roll up your sleeves and research.

Start with an online home value estimate

As a starting point, look at several online estimators for your home’s value. HomeLight’s Home Value Estimator aggregates publicly available data such as tax records and assessments, your home’s last sale price, and recent sales records for other properties in the same neighborhood.

We also add a new layer of information to our estimates using a short questionnaire. Tell us a few details about your North Carolina home, such as:

- How much work does it need?

- What type of home is it (single-family, condo, townhouse, or other)?

- Roughly when was your house built?

- Are you planning to sell soon?

Using these insights, we’ll provide you with a preliminary estimate of home value in under two minutes.

Whether you use Zillow, Chase, Realtor, or Redfin to get a home value estimate, think of any online home price tool as a first step (not your only source of truth) — and recognize that the data used may be limited.

Narrowly filter your search for comps

When you’re ready to find comps, you can choose from sites like Zillow, Trulia, Redfin, or Realtor.

You’ll want to filter your searches to the area very near your house (within blocks if possible) and with similar characteristics. If you’re not finding any comps, expand your search map.

You’ll also want to filter results by details like:

- Listing status (look at recently sold, pending, and active)

- Number of bedrooms

- Number of bathrooms

- Square footage

- Home type (single-family, condo, etc.)

Beyond the above criteria, the more houses you find with floor plans and an age similar to yours, the better.

Use a site like Zillow to collect your data

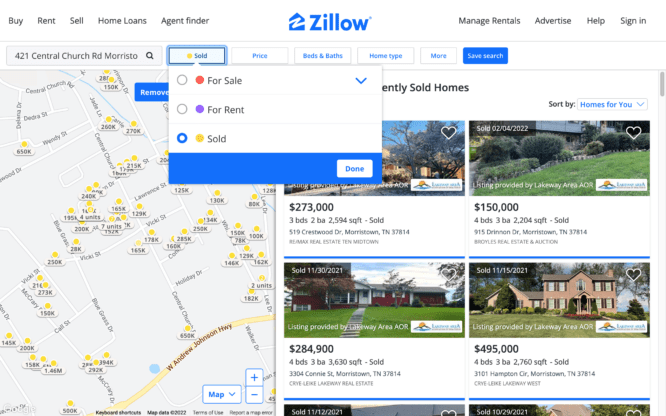

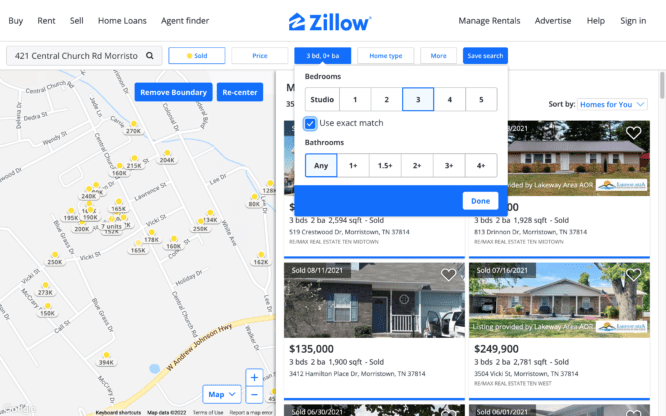

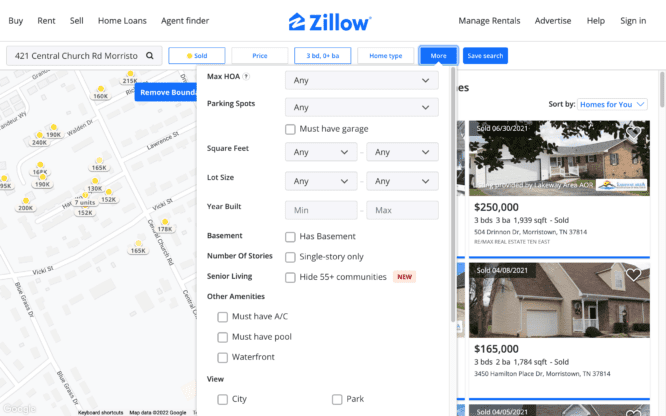

As an example, let’s take a look at how to filter your search for comps on Zillow.

- Navigate to Zillow.

- Type in your address. If a pop-up with your home’s specs appears, close it.

- Filter by “sold.” Yellow dots should appear on the map surrounding your house.

- Now, filter by the number of bedrooms and bathrooms and check the box “Use exact match.”

- Next, filter by home type.

- Next, select the “More” box. Here you can specify square footage, lot size, year built, and — crucially — the “sold in last” (time period) category.

- Scroll down and select to view houses that sold in the last 30 days.

- If you find there are not many results in your area, try expanding to 90 days. However, the further back you go, the less relevant the comps.

- If necessary, click the plus or minus buttons to widen the search area.

- Once you’ve collected data for sold houses, revise or restart the search to view active and pending listings, as well.

Invest in an appraisal

If you want to further reduce guesswork, top agents recommend paying an appraiser to provide a professional opinion of value for your home. An appraiser will combine recent property data, research of the surrounding market, and information collected from a walkthrough of your home to determine an appraised value. For a single-family home, an appraisal will likely cost $500 to $600 — well worth it to avoid possibly over- or underpricing your house by thousands.

Richter cautions FSBO sellers that private appraisals may differ from bank appraisals. “I tend to see that those come in much lower than actual market value,” says Richter. “Meet with a couple of professionals to get the best possible market analysis and valuation of your home.”

Make sense of the research

Compare your home’s features against the nearby comps you collected. Hopefully, the houses you studied give an indication of an appropriate price range for your home. From there, you can make dollar adjustments based on characteristics that add value (patios, curb appeal, an extra bedroom) versus detracting from it (a busy street, deferred maintenance, less square footage).

Consider the differences and similarities of comps with the appraised value of your home to choose a price that will encourage activity (too high and it may seem out of reach to many buyers), but will also maximize your profit.

3. Photograph your home

Listing photos are powerful, either pulling in buyers for showings or keeping them away.

To give your listing an edge, consider hiring an experienced real estate photographer. While they may charge as much as $140 to $180 an hour, Richter says professional photos can make or break a deal.

“Professionals capture an actual image of the home, versus just a couple of snapshots. It makes a huge difference,” he says. Richter also recommends getting drone photos to showcase the surrounding area.

If you do go the DIY route, make sure to:

- Use a good camera with a wide-angle lens.

- Pay attention to lighting.

- Include a photo of every room.

- Take multiple pictures of living areas, kitchens, and bathrooms.

- Try shooting different angles.

Review our guide on how to take quality real estate photos for further guidance.

4. Create a detailed, compelling listing

Along with stellar photos, you’ll want to craft an informative and compelling listing. Leverage both the listing description (a paragraph or two highlighting key features) and the property details to show potential buyers all about your home and what makes it desirable.

Tell a story with your description

Draw in potential buyers with a powerful listing description that tells a story about your North Carolina house, including details like:

- Your home’s most unique and desirable features, like a breakfast nook or sunroom

- Recent upgrades like a kitchen or bathroom remodel or new roof or HVAC system

- High-end appliances, materials, or finishes

- Outdoor features like a pool or patio

- Neighborhood features and amenities

- Nearby parks, walking trails, restaurants, and attractions

- Historic significance and vintage architectural styles such as Colonial, Federal and Georgian

“Don’t just sell the house — sell the area, the schools, the location, and proximity to hospitals,” advises Richter. “If you are providing information and insights just based on what the house has, you’re selling the lifestyle short.”

Lastly, and this is crucial: specify in your description the commission a buyer’s agent will receive from the proceeds. Most agents don’t want to show their clients properties from which they’d receive a paltry commission. When you list in the MLS, you must include a buyer’s commission. It can be as little as $1 but recognize that may limit your buyer pool as buyers’ agents typically expect to be compensated for their efforts. If you choose not to list in the MLS so you can forego the buyer commission, you’ll seriously limit the exposure your home will get.

Don’t skimp on the property details

Aside from writing the description, you may be prompted to enter information like:

- Age of the home

- Square footage

- Architectural style (i.e., split-level, rancher, craftsman)

- Appliances included

- Exterior building materials

- Flooring types

- HOA fees

- School zone information

- Lot size

Many real estate agents and potential buyers really do read this “fine print” on your listing — so include accurate details, and plenty of them.

Provide HOA or flood insurance specifications if they apply to your home. “Those things really can equip a buyer with the information they need to make a decision,” says Richter. Otherwise, the deal could fall apart if buyers can’t afford the additional costs.

5. List your home online

It’s finally time to post your North Carolina home online. While you can create FSBO listings for free on popular search sites, you’d have to painstakingly post site by site, and your listing wouldn’t reach the majority of buyers and agents.

To give your home the most exposure, pay to have your home put on your local MLS (multiple listing service) — a platform agents use to share properties with one another as well as major real estate sites. Posting there will feed your listing to buyers’ agent databases and to common sites buyers use.

Only licensed real estate agents and brokers who are MLS members can post to the MLS. However, you have two options to gain access: paying an agent to post for you or using a FSBO platform online.

Pay an agent to list your home on the MLS

A local agent may be willing to list your house on the MLS for a flat fee, without any other involvement in your real estate transaction. If you decide to go this route, ask whether the fee includes updating your listing if necessary.

Use a FSBO platform with an MLS option

You can use various paid websites to list your North Carolina house online as “for sale by owner.” These sites offer packages ranging from about $100 to $400 for just a listing, or a larger flat fee of $3,000 to $5,000 that includes any number of additional professional marketing services.

Some of these companies display their rates on their websites, but others won’t quote a fee until you input your address or select an area of the country. A few examples include:

- North Carolina Flat Fee MLS

- ISoldMyHouse.com

- FSBO.com

- Houwzer

- Clever Real Estate

- Homie Real Estate

- Assist-2-Sell

- Help-U-Sell

It’s important to note that most of these companies serve FSBO sellers nationwide, which can cause challenges if the assisting representatives don’t understand the local market trends in your North Carolina neighborhood.

Whatever you choose, read the fine print carefully: some sites may have hidden fees or even take a percentage off your sale — a detour you’d rather avoid on the FSBO route.

Not willing to pay for the MLS?

If you’re determined to save money by foregoing the MLS, creating a free FSBO listing on Zillow might be your top option. You can post a video and unlimited photos, and get fairly wide exposure via Zillow and the Zillow-owned Trulia.

6. Market your home

Now it’s time to spread the word about your North Carolina home.

Posting a home on the MLS is just the beginning of the marketing phase. A successful home sale requires a deliberate and targeted marketing plan to reach the right buyers and attract the best offers. As a FSBO seller, you do lose out on some of the marketing exposure an agent gives you, and your property will be competing with homes that are being sold with the benefit of the marketing tactics used by a professional agent.

There are, however, things you can do on your own to market your home and spark buyers’ interest!

Here are some of the steps you can take to market your home:

Place a nice FSBO sign by the road

Consider getting a custom yard sign rather than purchasing a generic one you write on with a Sharpie. You can order a custom sign on a site like Vistaprint with your contact information, plus a stand, for as little as $25 plus shipping. Note that some MLS providers may have rules about whether you can post a FSBO yard sign while your home is on the MLS.

Share on social media

Share your home across social media — and ask your friends to share, too.

Richter emphasizes the power of social media marketing to help cast a wider net and reach buyers in unlikely places. “It has a huge impact because you want to be in as many places as possible,” he says. “Buyers can be impulsive. They may not even be looking for that type of house, but then see that picture of the kitchen or the backyard or whatever the thing is that draws somebody in.”

Hold an open house

Try these strategies for a successful open house event:

- Share details on Facebook and Nextdoor.

- Update your MLS listing with the open house details (if you’re able to as part of paying the flat fee), or update your DIY FSBO listing.

- Place open house signs at nearby intersections.

- Tidy up the house before potential buyers come through.

- Pass out info sheets with the address, bullet points about the house, your contact info, and perhaps one photo.

- If you can, collect visitors’ info — then follow up later to ask if they have any questions.

Find more expert tips for how to hold an open house at this link.

7. Manage showings

If your marketing is successful, your next step will be to show the home to prospective buyers. Welcome to the busiest phase of the home sale process. One major reason some FSBO sellers switch to an agent is that they underestimated the time, energy, and expertise needed to manage this crucial step.

Communication may be a significant problem for FSBO sellers if their contact information is not readily available online or agents representing potential buyers can’t reach them to make an appointment. “Make sure that you have the systems in place so that people can contact you,” Richter advises. You won’t have many showings if buyers or their agents can’t get ahold of you.

To manage the logistics of showings:

- Respond to inquiries ASAP.

- Set end times if you need to fit many showings in one day. This will also create a sense of demand and urgency for buyers to place offers.

- Remove or secure valuables.

- Make sure the home is clean and tidy for showings.

- Follow up with buyers’ agents after showings to get their feedback.

Should you be present for showings?

If you’d rather not be present for every showing, consider using a lockbox with a code to let buyers’ agents enter the house. This is standard industry practice among agents. To ensure you’re working with someone legitimate, use Google or sites like arello.com to check their real estate license number. “In the perfect world, buyer and seller should never meet,” says Richter. There’s no need to be present if a licensed agent accompanies the buyer.

With unrepresented buyers, plan to be on the property for the showing. During a showing, we recommend you:

- Point out a few highlights of the house.

- Let buyers look without hovering.

- Be prepared to answer questions.

- Avoid the temptation to tell all — let the house and listing do the talking.

While you shouldn’t share too much information if talking to an unrepresented buyer, Richter says it’s better to over-disclose when it comes to your home’s condition. “A lot of ‘for sale by owner’ sellers get into hot water by under-disclosing,” he notes.

8. Evaluate offers, negotiate a deal, and make disclosures

You’ve got your first offer — congratulations! Before signing anything, Richter says, “It’s important to open a dialogue with the buyer’s lender to verify they do in fact have the ability to purchase that home.”

Sellers should also keep in mind that while buyers can often get pre-approved for a mortgage at the click of a button on a website, they may not have submitted the documentation to guarantee that approval. Or their employment or financial situation might have changed, thus affecting their ability to get a loan. “With our current climate of changing interest rates, that same pre-approval from a month ago may not be valid today for the price of their home,” Richter says.

Here are key considerations when considering an offer on your North Carolina home:

- Vet potential buyers by requiring a mortgage pre-approval letter or proof of funds.

- Require everything in writing.

- Remember, you can counter-offer and negotiate.

- Look for a good real estate attorney. (See the next step!)

Property condition disclosure

In North Carolina, sellers are required by law to disclose the full condition of the home to the buyer. This requirement not only protects the buyers from any “surprises” like leaking roofs or broken water heaters, but also protects the sellers from potential litigation. Known as the Residential Property Disclosure Act, the law applies to almost all transfers of residential real estate–even if you don’t have an agent. The disclosure must be provided no later than the time the buyer puts in their offer, so this is something you’ll want to have completed and ready before that offer is on the table.

In an agent-assisted sale, your listing agent would likely provide you with the required disclosure form(s). However, as a FSBO seller, you can find the form online.

What will you be asked? In North Carolina, you can expect to disclose any significant defects or issues you’re aware of concerning:

- Water supply and sewage disposal system (plumbing, water heater, septic, etc.)

- Electrical systems (light fixtures, garage door openers, smoke and burglar alarms, etc.)

- Heating and cooling system (central air, furnace, fireplace, propane tank, etc.)

- Roof (age, leaks, number of shingle layers, etc.)

- Structural components such as chimneys, flooring, basements, and foundation.

- Hazardous conditions (methane or radon gas, lead paint, mold, asbestos, etc.)

- Infestation of wood-destroying insects such as termites, or past infestation that has caused damage that has not been repaired.

- Other disclosures (land use, encroachments, zoning or code violations, moisture or water problems, etc.)

If in doubt about a problem with the home’s condition, most top real estate agents would recommend you disclose it. If you know of an issue and choose not to disclose a major problem, and that defect is later discovered, you could be held liable for damage or subsequent costs.

9. Close the sale — with professional help

Time to button up that deal.

Because North Carolina is one of several states that require a real estate attorney for closing, you’ll already have an attorney handling the bulk of the closing and verifying documentation. Additionally, you may want to hire your own attorney ahead of time to review your paperwork and make sure you haven’t missed anything.

Even if hiring an attorney was optional in the state, Richter says that it’s important to hire your own attorney “so that you have somebody protecting your interest if there are any disputes down the line.”

Real estate attorney fees can vary depending on location and how much help you want or need. In North Carolina, the average hourly rate for a real estate lawyer is about $310, which might be well worth it for professional guidance in closing one of life’s largest legal transactions.

FSBO mistakes to avoid in North Carolina

On your FSBO journey, watch out for these major pitfalls:

- Missing out on the MLS.

- Forgetting or refusing to pay the buyer’s agent commission.

- Over- or under-pricing.

- Letting your house sit on the market too long.

- Not getting enough marketing exposure.

- Being overly fixated on any one detail.

- Not showing your home’s full potential if you don’t declutter and remove personal decor.

Shull explains that one of the biggest mistakes sellers make is getting too emotional about the process. “Twenty to 25 percent of the deals I’ve negotiated would’ve been blown by an emotional reaction. Many sellers shut down during negotiations. They need to take a lot of breaths. They need to take time to evaluate the upside and the downside of any decision. In a negotiation, it’s crucial to focus on the logic,” she says.

You also don’t want to make the common FSBO mistake of letting home inspection issues delay or even kill a deal. “Have the pre-inspection done so that you can be ahead of any potential issues,” Richter suggests. Rectify problems ahead of time so the buyer’s home inspection goes much smoother, thus leading to a quicker and less stressful sale.

Alternatives to selling by owner in North Carolina

If you decide you don’t want the hassle or pressure of FSBO, you’ve got other solid options.

Enlist the help of a top-rated real estate agent

Ultimately, the services and price gains you can get with an experienced real estate agent may put more money in your pocket than FSBO. A proven agent is also better equipped to help you achieve your selling and moving timelines.

Richter shares an experience with a client who unsuccessfully tried to sell his house by owner to save commission. He placed a sign in the yard and took some photos with his cellphone, but after spending about 40 days on the market he turned to Richter to sell his home. “Then I stepped in. Brought my drone. We did a virtual 3-D walkthrough. We did a social media blast,” says Richter. A top agent helped the FSBO seller-turned-client sell the home at a price that greatly exceeded his expectations.

Interested in such expertise? HomeLight can connect you to top-performing agents in your North Carolina market. Our free tool analyzes over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. It takes only two minutes to receive your matches.

Request a cash offer to buy your North Carolina home

If you’d like to skip the sale prep altogether — plus avoid paying agent commissions — you can opt to sell your home “as-is” to an all-cash buyer instead.

For a low-stress experience, consider requesting a cash offer from HomeLight’s Simple Sale platform. Tell us a few details about your home, and in as few as 48 hours, we’ll send a no-obligation all-cash offer your way. If you decide to accept the offer, Simple Sale sellers have the ability to close in as little as 10 days.

Without leaving the Simple Sale platform, you’ll also be able to compare your cash offer to an estimation of what your home would sell for on the open market so you can make an informed decision.

Ready to sell your North Carolina home?

Unless you already have a buyer lined up, selling a house by owner in North Carolina requires a significant investment of time and effort. You’ll need to pull your own comps, capture excellent pictures, create a listing, market the house online, field inquiries, host showings, negotiate, and close the deal. And that’s after preparing the house itself.

You also have to consider that FSBO listings tend to sell for less than agent-assisted sales. An experienced agent who knows the area can make recommendations for targeted upgrades to help you maximize your sale price and get a premium offer. This can help to offset or, in some cases, more than make up for the cost of commission — while saving you time and headaches.

If you choose to go FSBO, you should have a good idea now of what to expect from the process. Otherwise, our internal transaction data at HomeLight shows that the top 5% of real estate agents sell homes for as much as 10% more than average, and we’d be happy to introduce you to some of the best agents in your North Carolina market.

Writer Hayley Abernathy contributed to this story.

Header Image Source: (Gene Gallin / Unsplash)